Escribe: Nicholas Davenport

(N.E. Se lamenta Nick Davenport de lo poco riguroso que ha sido el control bancario en esta crisis que todavía no termina e igualmente clama contra procedimientos demasiado burocráticos en el control de la actividad aseguradora que puede poner en peligro la perennidad de un sistema de distribución que durante siglos ha sabido cumplir con su papel y adaptarse. Todo llega tarde y mal advirtiendo que los consumidores debieran preguntarse a quién beneficia un sistema de supervisión que es pagado por todos los ciudadanos para finalmente producir ingentes beneficios a los grandes grupos multinacionales, incluidos los seguros en detrimento de otros más pequeños que se ven desbordados por las exigencias burocráticas. Una confusión de seguros de ahorro y previsión con los seguros de daños en materia de compensación económica a los intermediarios puede resultar especialmente dañina y conviene reaccionar)

As the world economy struggles to emerge from the Great Financial Meltdown, albeit with most Western economies well embarked upon their own Japanese-style “lost decade” of stagflation, it is worth reflecting on the cost-benefits of financial regulation.

Let us not discuss Banking: the lessons are relatively clear. Everything failed: the regulators, the rating agencies, and the banks themselves, both financially and morally. European regulators are trying to rewrite the rulebook (MIFID 2). Already by the time this is published, the rules will be out of date. There will be a new crisis because someone has found a way around them. The only beneficiaries will be the incremental horde of regulators themselves, living in many cases off the carcases of their victims (some financial regulators are substantially funded by fines the levy on the industry they regulate).

General insurance is also a “financial service”, and as such is unquestioningly lumped in with the new European banking regime. For example: commissions paid to professional intermediaries are a bad thing, there must be total transparency of remuneration and all distribution structures are inherently suspicious.

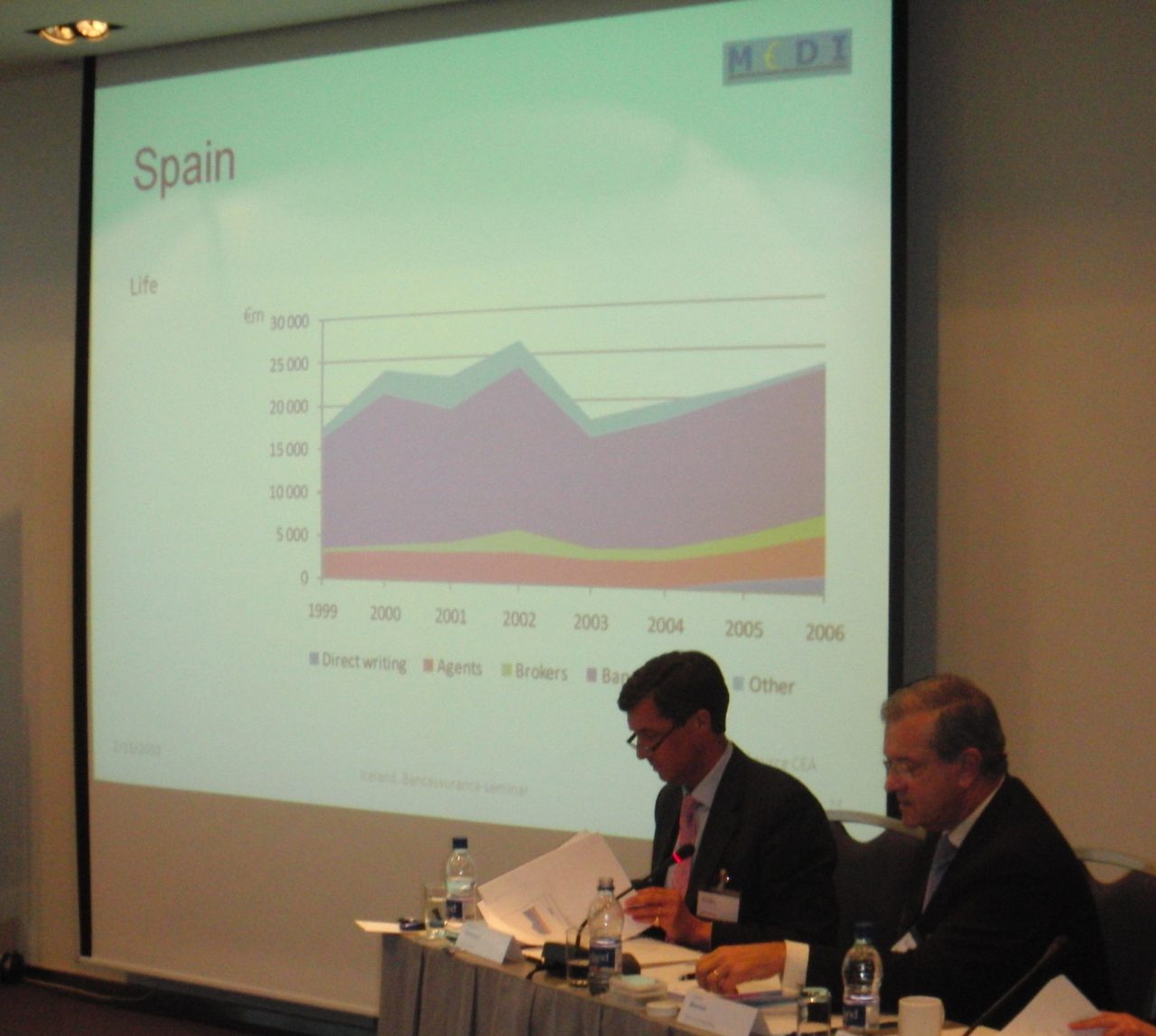

In fact, General Insurance (ie excluding Life insurance with investment) is different. It does not pose systemic risk (except where insurance companies use their balance sheets to venture into investment banking, or where banks sell worthless insurance – PPI in the UK – for motives of short-term profit). Insurer and intermediary failures with client detriment are relatively rare. Distribution structures have evolved over centuries to fit the requirements of different national laws. It should not require pan-European initiatives to force-change these structures. The consumer always picks up the bill for these in the shape of increased premiums.

Solvency 2 – a vast all-encompassing bureaucratic version of Enterprise Risk Management – has so far cost European insurers (and thus consumers) billions of euros, for no result – in fact in exchange for a period of 3 years at least where the situation is more confused than before. The second Intermediaries Directive (IMD2) is estimated by the Commission itself to cost European brokers and agents €750 million, and in practice it will of course be much more.

All this extra cost is supposedly to protect consumers from the (relatively rare) occurrences of insurer bankruptcy, such as the Independent (remember that?), and to protect them from the supposedly biased advice of their wicked local insurance agent. No sooner are the new regulations in force than new unregulated forms of insurance distribution will appear, consumers will suffer from a new scandal, and a fresh wave of pan-European regulation will be called for by the politicians in Brussels.

Consumers should question the value for money they receive from their regulators for such “protection”. They should do this through their Consumer Associations. The powerful sleeping giant insurance industry should wake up and lobby fiercely against ineffectual regulation and the huge-scale waste of money it is forced to spend on Compliance. It should do so through its professional associations, both insurers’ and intermediaries’, preferably both acting together. These associations, whilst they may serve their membership well in many respects, have so far been signally ineffective on the major regulatory issues.

The only beneficiaries of the current wave of regulation of General Insurance are the three or four European insurance mastodons who can afford the vast cost of compliance and who might be suspected of welcoming a weakened intermediary sector which cannot stimulate effective competition on behalf of consumers; as well as of course the swelling ranks of the regulators themselves. What of the smaller innovative insurers, the Mutuals, the captives, the trusted local advisers, the brokers who force insurers to compete on price? All these business models are threatened because they are lumped into the same regulatory category – financial services – as the supposedly evil bankers. Yet these are the professionals who in their vast majority live by their reputations of genuinely caring for their customers and by their vocation of optimising the terms and price of their clients’ vital insurance protection. In over-regulating General Insurance, we will lose much more than we gain. And we continue to add costs to the European economy and to make it less competitive.