[box style=»2″]

N.E.

Quienes acudan a la conferencia Life Insurance Challenges 2015 el 18 de junio en el Hotel Hesperia de Madrid tendrán ocasión de escuchar a Mathilde Sauvé que a buen seguro se extenderá sobre la ideas que expresa en el artículo que ha escrito para el blog de Community of Insurance y que se puede leer a continuación.

Mathilde Sauvé, gran conocedora del momento actual financiero nos ofrece una buenas pautas sobre la gestión de inversiones en un momento como el actual caracterizado por “el descenso de los tipos de interés y la consiguiente baja del rendimiento de las inversiones y erosión de los márgenes de capital de Solvencia II”.

Una lectura atenta del artículo nos presenta el panorama actual – “menos grave para las Compañías españolas” según Sauvé – así como sus recomendaciones que nos atrevemos a calificar de valientes y sensatas, demostrativas de su profundo conocimiento de la situación, orientadas a la diversificación y el aprovechamiento del momento actual de la renta variable.

Además sugiere llevar a cabo estrategias convertibles con protección mediante el uso de derivados.

A la vista de sus reflexiones no tenemos duda que quienes se dedican a la gestión de inversiones y acudan a la conferencia encontrarán en la intervención de Mathilde Sauvé fuentes de contraste con sus propias posiciones y decisiones.

Un interés mayor si cabe para aquellos gestores de Compañías medianas o pequeñas que también podrán realizar networking eficaz sobre herramientas de gestión más sofisticadas y posibilidad de acceso a mercados financieros globales y complejos porque nos consta que AXA Investment Managers ofrece sus servicios y know how financiero a muchas Compañías por todo el mundo.

[/box]

Escribe: Mathilde Sauvé, Investment solutions for Insurers – AXA Investment Managers

Escribe: Mathilde Sauvé, Investment solutions for Insurers – AXA Investment Managers

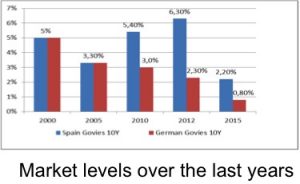

The current investment environment is challenging for European insurers. Low interest rates have lowered their investment returns and eroded their Solvency II capital margins.

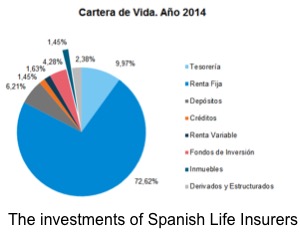

In Spain, the situation looks less urgent than elsewhere in Europe. During the EU crisis, insurers massively invested into domestic government bonds, thus, locking in high returns at zero capital charge. Furthermore, part of their employee benefit business has a favourable treatment under Solvency II (named Matching adjustment).

However, if low interest rates persist, new money and maturing assets will be reinvested at much lower yields; as a result, insurers’ profit will significantly deteriorate.

The question of reinvestment needs to be addressed now.

[box style=»1″]

[/box]

Where to start ?

Experience from the crisis teaches that diversification is key in portfolio construction. In the context of ultra-low yields, insurers have to go beyond the paradigm of domestic government bonds and Euro investment grade credit.

Solutions implemented with our clients in Spain and more generally in Europe are discussed below.

Diversification into non-Euro Fixed-Income

Since 2013, the spread between USD and EUR rates has widened significantly, creating opportunities for European investors (2.7% vs 1% on IG credit).

For insurers able to manage the risk of foreign exposure in their portfolios, US and Global IG Credit offer opportunity to complement and improve €-IG credit yield through credit spread, currency exposure and interest rate carry trade.

Make use of illiquidity premium

Investments in less liquid instruments such as corporate loans (4-5% yield), commercial real estate loans (2.5-3% yield) and infrastructure offer attractive liquidity premiums and risk/return profiles in the current low yield environment. Moreover, they perfectly fall within the “Direct lending and Real assets” thematic and receive favourable treatment under Solvency II.

Today, less liquid assets represent one third of insurers’ reinvestment plans – despite issues sometimes daced in ramp-up due to scarcity of investment opportunities. According to market studies, insurers’ allocation to these assets is expected to increase from 5% to 15% by 2018.

The right time to reconsider Equity investments

Over the last decade, European insurers have significantly reduced their equity exposure due to high volatility and Solvency II pressure. In Spain, the average equity allocation is currently about 3%.

2015 is an opportune year for selectively investing in equities to benefit from the strong momentum spurred on by European monetary policy. Moreover, under the Solvency II grandfathering rule, equity investments made before December 31st 2015 will, for some time, benefit from lower capital charges – 22% instead of 39%.

Convertible strategies and equity protected strategies with the use derivative-based overlays offering moderate volatility and optimising Solvency II capital charges are typically options to consider.

How to pull it all together

As the investment mix becomes more sophisticated, insurers have to rely more on external asset managers to access competencies that they do not have in-house such as investing in loans and infrastructure or using derivatives.

The challenge is to select asset managers who are able to deliver expected returns, especially, on less liquid and add value along the whole investment chain – from asset allocation to reporting in a new Solvency II world.